On January 20, 2016, Adam Foulke, Senior Vice President, Business Development at Battea, addressed a group of prominent pension fund trustees at Koried’s 7th Annual Plan Sponsor Educational Institute in Key West, FL. His audience consisted of trustees who were responsible for over $100 billion in retirement fund investment assets. In his presentation, “Monitoring Your Portfolio: A Discussion of Securities Class Action Litigation and Settlement Recoveries,” he advised them how utilizing the services of a dedicated securities claims filing firm like Battea could help them maximize the value of their class action claims. By using a firm like Battea, he said, pension funds have the best chance of not leaving crucial money on the table that they and their pensioners are entitled to.

Adam Foulke, Senior Vice President, Business Development

He pointed out that of the $90 billion in settlements since 1996, $23 billion represent undistributed settlement funds.

“The inefficiencies and increasing complexity of maximizing recoveries via claims processing is the very reason Battea exists,” he said.

In the handling of a securities class action, much depends on the shoulders of the court-appointed claims administrator. But as Adam pointed out, often claims administrators reject claims because of incomplete or fragmented trading data. Battea’s advantage is that it’s a leading expert in the handling of trading data, and because of its thoroughness and innovative practices in the field of data handling and security, Battea is often able to win the client substantial funds that they would have been otherwise denied.

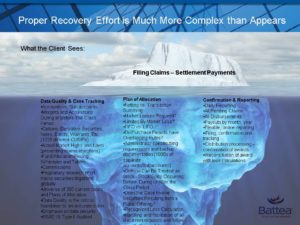

The tip of the iceberg: Adam used this slide to illustrate the hidden complexity of data handling and security in filing securities class action claims

Who files claims? They can be handled in-house by the injured pension fund itself, by custodian banks, by law firms, or by financial recovery vendors like Battea. The types of claims can relate to equities, bonds, derivatives, or such non-equity sources as credit default swaps (CDS), interest rate swaps, or foreign exchange transactions.

Further complicating matters, Adam said, is foreign litigation, which is not like the U.S. system and gives investors the choice of opting-in versus opting-out of the class action. Foreign litigation becomes a vital issue for pension funds to consider in light of the increasing velocity of filings and global connectedness of capital markets. Adam discussed the litigation funding options available to investors and posed the important question: how do I monitor these class action lawsuits?

“What types of monitoring tools are out there, and what’s right for my fund?” he said. The answer: monitoring tools are provided by law firms, custodian banks, and specialized vendors like Battea.

Adam went on to pose the most important question for the audience: “How can I be sure I’m not leaving money on the table?” His reply: engage Battea! In many, many instances, Battea has been able to obtain funds for clients that otherwise would have been impossible for them to receive. Also, since Battea executives have longstanding personal relationships with many claims administrators, they are often able to intercede on the behalf of clients in order to resolve knotty administrative problems.

Let’s face it: $23 billion in undistributed settlement funds is not small change, and even a small fraction of that sum can make a world of difference for a pension fund’s retirees.

Adam’s speaking engagement is the second time in a month that a Battea executive has appeared before public pension fund representatives to counsel them concerning their securities class action filing options. On January 14, 2016, Trent Calabretta, Vice President and Manager of Western US Sales, delivered a presentation entitled, “Defending Your Assets,” to the Public Funds Summit in Scottsdale, AZ. Clearly Battea is reaching out to share its thought leadership with potential clients and to demonstrate to public pension fund trustees what their range of options is when faced with securities fraud.