Deal Deep Dive: SS&C Bets on Synergies with Battea Acquisition

Fintech giant SS&C expects to bolster Battea’s reach through cross-selling opportunities Jan. 7, 2025 /Middle Market Growth/ /Anastasia Donde/ -- When SS&C acquired securities class ...

SS&C Technologies Completes Acquisition of Battea-Class Action Services

WINDSOR, Conn., Sept. 30, 2024 /PRNewswire/ -- SS&C Technologies Holdings, Inc. (Nasdaq: SSNC) today announced it has completed its acquisition of Battea-Class Action Services, LLC, a market-leading provider of ...

SS&C Technologies to Acquire Battea-Class Action Services, Expanding Securities Class Action Claims Management Offerings

WINDSOR, Conn., Sept. 12, 2024 /PRNewswire/ -- SS&C Technologies Holdings, Inc. (Nasdaq: SSNC) today announced a definitive agreement to acquire Battea-Class Action Services, LLC, a market-leading provider of securities class action claims management and ...

SETTLEMENT UPDATE: $200 Million Uber Technologies Settlement

$200 Million Uber Technologies Settlement Battea is providing the information below to alert you of the recent developments in the Uber Technologies Settlement. The filing ...

SETTLEMENT UPDATE: $434 Million Under Armour Settlement

$434 Million Under Armour Settlement Battea is providing the information below to alert you of the recent developments in the Under Armour Settlement. The filing ...

SETTLEMENT UPDATE: $65 Million Apache Corp Settlement

$65 Million Apache Corp Settlement Battea is providing the information below to alert you of the recent developments in the Apache Corp Settlement. The filing ...

SETTLEMENT UPDATE: $97 Million Perrigo Company Settlement

$97 Million Perrigo Company Settlement Battea is providing the information below to alert you of the recent developments in the Perrigo Company Settlement. The filing ...

SETTLEMENT UPDATE: $350 Million Alphabet Inc. Settlement

$350 Million Alphabet Inc. Settlement Battea is providing the information below to alert you of the recent developments in the Alphabet Inc. Settlement. The filing ...

Battea Q1 2024 Client Newsletter

Battea Q1 2024 Client Newsletter KEY TAKEAWAYS In the recent Securities Class Action Settlements Report from Cornerstone Research, "The [2023] median settlement amount of $15.0 ...

SETTLEMENT UPDATE: $580+ Million Stock Loan Antitrust Settlement

$580+ Million Stock Loan Antitrust Settlement Battea is providing the information below to alert you of the recent developments in the Stock Loan Antitrust Litigation Settlement. ...

Battea Class Action Services appoints Michael J. McCreesh as CEO

Appointment of Michael J. McCreesh as Battea CEO STAMFORD, Conn., Dec. 13, 2023 /PRNewswire/ – Battea Class Action Services, LLC, the leading global experts in providing ...

Battea Q3 2023 Client Newsletter

Battea Q3 2023 Client Newsletter KEY TAKEAWAYS There’s more than $2.2B available to eligible investors in some of the largest securities class and collective action ...

Dutch Court Enters Interim Merits Judgment in Favor of Petrobras Investors

Petrobras Shareholders Litigation By Kevin LaCroix In a milestone development in the long-running Dutch collective investor action brought against Petrobras and related entities, a Netherlands ...

Big Step Towards Compensation for International Shareholders and Investors Against Petrobras in EU-Based Class Action in Netherlands Court

After 7 years of litigation and almost falling off the investment community’s radar, the Stichting Petrobras Compensation Foundation—supported by many international Petrobras shareholders and bondholders—achieves ...

Battea Class Action Services Announces the Successful Integration of its Digital Asset Recovery Technology (“DART”) to help Institutional Investors in Recovering Damages Related to Cryptocurrency Investments

STAMFORD, Conn. – July 11, 2023 – Battea Class Action Services, LLC, the global leading expert in providing turn-key class and collective action antitrust and ...

Battea Class Action Services Announces Partnership with SimCorp to Provide its Clients with Best-in-Class Global Damage Analysis & Securities Class and Collective Action Claim Filing

Stamford, CT – June 27, 2023 – Battea Class Action Services, LLC, the global leading expert in providing turn-key class and collective action antitrust and securities ...

Battea Q1 2023 Client Newsletter

Battea Q1 2023 Client Newsletter Antitrust Settlement Funds with Imminent Claims Filing Deadlines Settlement:Settlement Fund:Claims Filing Deadline:Class Period: AUSSIE BENCHMARK FIXING (BBSW) SETTLEMENT$185,875,000January 16, 2023January ...

Convergence League Table & Industry Discussion

Convergence League Table & Industry Discussion In the 24th installment of the Convergence League Table & Industry Discussion, Battea's Mike McCreesh and Bob Donahoe, joined ...

Battea International Litigation Spotlight: Australia

Battea International Litigation Spotlight: Australia In another installment of Battea’s “International Litigation Spotlight", David Abel, External Counsel to Battea Class Action Services, along with Brett ...

Battea International Litigation Spotlight: Ireland

Battea International Litigation Spotlight: Ireland In the first installment of Battea’s “International Litigation Spotlight", David Abel, External Counsel to Battea Class Action Services, and Kyle Nolan, Associate, Maples ...

Battea Q4 2022 Client Newsletter

Battea Q4 2022 Client Newsletter Battea 2022 Client Newsletter: Settlement Funds with Imminent Claims Filing Deadlines [table “” not found /]

SIBOR SOR SETTLEMENT: ELIGIBLE ...

SIBOR SOR SETTLEMENT: ELIGIBLE ...

BATTEA HALF-YEAR 2022 CLIENT NEWSLETTER

The Battea Report: Half-Year 2022 Client Newsletter Settlement Funds with Imminent Claims Filing Deadlines [table “” not found /]

BLACKBERRY LTD. SETTLEMENT: ELIGIBLE CLASS: All ...

BLACKBERRY LTD. SETTLEMENT: ELIGIBLE CLASS: All ...

Battea Class Action Services Announces Partnership with HC Global Fund Services to Provide Best in Class Global Damage Analysis & Securities Class and Collective Action Claim Filing

Battea Partners with HC Global Fund Services BATTEA CLASS ACTION SERVICES ANNOUNCES PARTNERSHIP WITH HC GLOBAL FUND SERVICES, LLC TO PROVIDE BEST IN CLASS GLOBAL ...

Battea Class Action Services Announces Partnership with WTax to Provide Best in Class Global Damage Analysis & Securities Class and Collective Action Claim Filing & Withholding Tax Reclaim Services

Battea Partners with WTax Battea Class Action Services Announces Partnership with WTax to Provide Best in Class Global Damage Analysis & Securities Class and Collective ...

Battea Class Action Services Announces Partnership With Commerce Street Holdings to Provide Best in Class Global Damage Analysis & Securities Class and Collective Action Claim Filing

Battea Partners with Commerce Street Battea Class Action Services Announces Partnership With Commerce Street Holdings to Provide Best in Class Global Damage Analysis & Securities ...

BATTEA 2022 CLIENT NEWSLETTER

The Battea Report: Q1 2022 Client Newsletter Settlement Funds with Imminent Claims Filing Deadlines [table “” not found /]

COMEX GOLD FIXING TRADING SETTLEMENT: ELIGIBLE ...

COMEX GOLD FIXING TRADING SETTLEMENT: ELIGIBLE ...

Battea Class Action Services Chairman Appointed to 2022 CII Markets Advisory Council

Battea Class Action Services Announces Its President, Michael J. McCreesh, Has Been Appointed to The Council of Institutional Investors 2022 Markets Advisory Council STAMFORD, Conn., ...

Battea Class Action Services LLC Announces Sale of Minority Interest in Transaction With TowerBrook Capital Partners

Battea Minority Interest Transaction November 03, 2021 07:59 AM Eastern Daylight Time STAMFORD, Conn.--(BUSINESS WIRE)--Battea Class Action Services, LLC (“Battea” or “the Company”), a global ...

Petrobras Shareholders Burned by ‘Carwash’ Turn to Dutch Court

Petrobras Shareholders Litigation By Peter Millard Dutch class-action case brings together investors outside U.S. Petrobras vows to continue fighting case during merit phase Petróleo Brasileiro ...

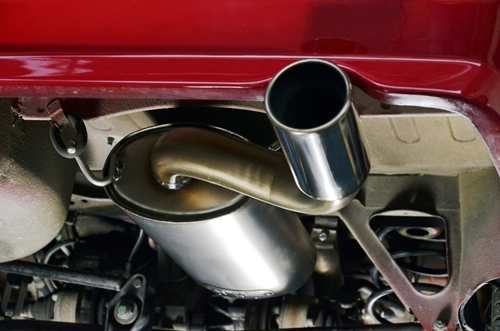

Volkswagen and BMW are fined nearly $1 billion for colluding on emissions technology

Volkswagen Fined $1 Billion By Jack Ewing Germany’s three largest carmakers colluded illegally to limit the effectiveness of their emissions technology, leading to higher levels ...

Dutch Court Overturns Ruling in Petrobras Fraud Suit

By Cosmo Sanderson Global Arbitration Review, London (June 18, 2021, 6:25 PM BST) — A Dutch court has reversed its decision to exclude certain claimants ...

Battea 2021 Client Newsletter

Battea 2021 Client Newsletter Outside of settled cases, the decline in filed cases in 2020 is largely due to business environment interruptions and the impact ...

Battea and Apex announce partnership for hedge funds, litigation and data analysis

Battea Announces Apex Group Partnership Stamford, CT—Battea Class Action Services, LLC, a global expert in providing turn-key class and collective action antitrust and securities litigation ...

Market Monthly Newsletter – More than $2.824 Billion settled in the first three quarters of 2020

Battea's Market Monthly Newsletter: November 2020 More than $2.824 Billion settled through Q3 2020. Urgent Deadlines Loom in Several LIBOR-Based Antitrust Litigations. BILLIONS OF DOLLARS ...

Institutional Investor Webinar: There’s Currently $15 Billion Available To Eligible Investors. Interested to learn how you can recover?

Institutional Investor Webinar: There's Currently $15 Billion Available To Eligible Investors. Interested to learn how you can recover? Institutional Investor Webinar: Securities class action settlements ...

Battea Class Action Services Announces Partnership with HedgeServ to Provide its Clients with Best in Class Global Damage Analysis & Securities Class and Collective Action Claim Filing

Battea Announces HedgeServ Partnership Stamford, CT—Battea Class Action Services, LLC, the global leading expert in providing turn-key class and collective action antitrust and securities litigation ...

CII Webinar: State of Securities & Antitrust Class Action Litigation and Impact of Covid-19

CII Securities Litigation Webinar CII Webinar: State of Securities & Antitrust Class Action Litigation and Impact of Covid-19 Securities class action settlements help investors recoup ...

First Quarter 2020 Newsletter

First Quarter 2020 Newsletter There has been incredible growth in securities and antitrust class action litigations and settlements, particularly as they have unfolded in the ...

Battea Class Action Services Statement Regarding Coronavirus (COVID-19)

Battea Class Action Services Statement Regarding Coronavirus (COVID-19) At Battea, the health and safety of our employees, clients’ and business partners’ staff, together with consistent ...

Institutional Investor Group From Across 16 Countries Announces Its First Filing of More Than One Billion DKK Initial Lawsuit in a Series of Planned Filings Against Danske Bank A/S

The ISAF Coalition for Damaged Danske Bank Investors is suing Danske Bank for failing to disclose both Financial and Regulatory material risks, as required under ...

Battea Helps Raise More Than $200k for Kids In Crisis at their 2019 Kids Challenge Golf Tournament

Battea Class Action Services Sponsors 2019 Kids Challenge Golf Tournament Battea Sponsors Golf Tournament: The event, which took place on September 23rd, 2019 and was ...

Battea Class Action Services, LLC hires Michael J. McCreesh, a seasoned Goldman Sachs Managing Director, as President.

Battea Class Action Services, LLC, the global leader in institutional investor Class and Collective Action Investment Recovery Services, today announced the hiring of Michael J. ...

Battea Hosts New Member & First-time Attendance Welcome Reception at CII Fall Conference in Minneapolis

Battea - CII Fall Conference Battea Class Action Services, LLC was honored to host all CII Board Members, Markets Advisory Council, Shareholder Advocacy Committee, as ...

Battea Hosts Financial Executives Alliance Hedge Fund Networking Luncheon in New York City

Battea – Hedge Fund Luncheon Battea Class Action Services, LLC was honored to host all Financial Executives Alliance (FEA) members on September 10, 2019, at ...

Battea Supports 54th Stamford Denmark Race At Stamford Yacht Club

On Sunday, September 8, 2019, more than 80 boats raced in the 54th Stamford Denmark Race At Stamford Yacht Club. This was also the inaugural ...

Battea – Class Action Services, LLC Successfully Completes 8th Straight SSAE 18 Type II Examination Audit

Battea Class Action Services Achieves SSAE 18 Type II Examination Audit for Ninth Straight Year STAMFORD, Conn.--Battea – Class Action Services, LLC, global leader and ...

Canadian Foreign Exchange Settlement Update

$106 Million Canadian Foreign Exchange Settlement Update: The filing deadline in the CAD $106,747,205 Foreign Exchange Canadian Litigation Settlement is January 20, 2020. Complex Securities: Most, if not all of these instruments ...

Market Monthly Newsletter: Danske Bank Investor Scandal; Securities & Antitrust Settlement Funds; Upcoming ADR Settlements

More Than $15 Billion Available to Eligible Investors Nearly $6 billion dollars settled across the foreign exchange antitrust manipulation cases, derivatives cases, and the Petrobras American Depository ...

CIO Applications Magazine Appoints Battea Class Action Services to Top 25 Fintech Solution Providers

Battea Class Action Services is very proud to announce that the Firm has been named selected by CIO Applications, specialists in innovation and technology, as ...

Battea Leads Panel at Koried’s 10th Annual Plan Sponsor Educational Institute

On January 16, 2019, for the fifth straight year, Battea, addressed a group of prominent pension fund trustees at Koried’s 10th Annual Plan Sponsor Educational ...

Prominent Coalition of World Class International and Danish Law Firms and ISAF Management Company Proceed with Investor Lawsuit against Danske Bank

ISAF Danske Bank Lawsuit CONN, Stamford– International Securities Associations and Foundations Management Company (“ISAF”) announces the formation of an international coalition of leading American, German and ...

Battea Sponsors Europe’s Largest Fixed Income Event in Amsterdam

Battea Hosts Europe's Largest Fixed Income Event Battea – Class Action Services, LLC was honored to sponsor the Fixed Income Leaders Summit (FILS) on Wednesday, November ...

Battea Hosts New Member & First-time Attendee Welcome Reception at CII Fall Conference in New York City

Battea Hosts CII Fall Conference Welcome Reception in New York City Battea – Class Action Services, LLC was honored to host all CII Board Members, ...

Cybersecurity Demands and Securities Class Action Recoveries – Regulations continue to grow in the alternative investment space

Cybersecurity Demands and Securities Class Action Recoveries - Regulations continue to grow in the alternative investment space. Institutional investors have found themselves to be the ...

Dutch Court OKs Petrobras Claim Jurisdiction Despite Brazilian Arbitration Clause

Dutch Court OKs Petrobras Claim Jurisdiction Despite Brazilian Arbitration Clause By Kevin LaCroix on September 23, 2018 In a development with significant implications both for Petrobras investor claims ...

Litigation Researchers Believe – Dutch Court Ruling – Big Blow to Petrobras’ Arbitration Strategy

"The ruling is a big step toward investors’ outlook for recovery of some of the billions lost, whether losses incurred in U.S. dollars, Euros, Brazilian ...

Battea Hosts New Member & First-time Attendee Welcome Reception at CII Spring Conference in Washington D.C.

Battea – Class Action Services, LLC was honored to host all CII Board Members, Markets Advisory Council, Shareholder Advocacy Committee, as well as all new ...

Bloomberg Markets – FX-Rigging Antitrust Settlement

FX-Rigging Antitrust Settlement By Lananh Nguyen March 13, 2018, 10:42 AM EDT FX-Rigging Antitrust Settlement: Currency investors now have two more months to file claims ...

Battea Class Action Services, LLC Chairman Appointed to 2018 CII Markets Advisory Council

Stamford, CT — Battea Class Action Services, LLC, global experts in litigation research, data auditing and monitoring, claims filing, and settlement recovery, is proud to announce its ...

Battea Documents Record Growth in the Securities and Antitrust Class Action Industry – Exclusive with AIMA Journal

Kevin Doyle, Global Head of Marketing at Battea Class Action Services, presented an in-depth analysis on record growth in securities class action litigations in the ...

Financial Times – Legal Services Start-ups Target Lawyers’ Paperwork

Financial Times "Lawtech" Litigation How much more efficient would it be, then, for an investor who has lost out because of fraud to have a ...

Forterra, others served with shareholder class action lawsuit

The water and drainage pipe manufacturer Forterra, Inc., along with a handful of its executives and dozens of other parties, have been named as defendants ...

Bloomberg Markets – Currency-Rigging Scandal Leaves $2.3 Billion Up for Grabs

Currency Rigging Scandal $2.3 billion By Lananh Nguyen September 12, 2017, 9:06 AM EDT This article can be found on Bloomberg Markets website. Currency investors ...

Rayonier, executives named defendants in shareholder class action suit

Rayonier Securities Litigation: The manufacturing company Rayonier Advanced Materials and two of its executives were recently named as defendants in a securities class action lawsuit, ...

Lexmark International, four executives face shareholder class action

Lexmark International, Four Executives Face Shareholder Class Action The business services and products firm Lexmark International and four of its current or former executives named ...

Axiom Holdings faces shareholder class action suit over failed merger

Axiom Securities Class Action The multifaceted Hong Kong-based company Axiom Holdings and its chief executive officer were recently named as defendants in a securities class ...

Battea Featured in US FX Benchmark Litigation Analysis – Exclusive with FX Week

Battea Featured in US FX Benchmark Litigation Analysis – Exclusive with FX Week Battea – Class Action Services, LLC Chairman, Peter Kilbinger Hansen, was asked ...

CenturyLink, three execs face shareholder class action suit

The telecom company CenturyLink and three of its executives named as defendants in a shareholder class action lawsuit alleging a number of failed disclosures related ...

Battea’s Chairman Peter Kilbinger Hansen Featured in ‘Last Look’ Analysis – Exclusive with MNI Market News’ Vicki Schmelzer

By Vicki Schmelzer NEW YORK (MNI ) - When the Foreign Exchange Working Group released the Global Code of Conduct for the foreign exchange industry ...

Battea’s Chairman Peter Kilbinger Hansen Presents on Global FX Antitrust Litigation at FX Week USA Conference in New York City

FX Week Conference - Global FX Antitrust Litigation & Settlement Battea – Class Action Services, LLC Chairman, Peter Kilbinger Hansen, was honored to present on ...

HD Supply faces shareholder class action suit over earnings shortfalls

The industrial products distributor HD Supply Holdings, Inc., and two of its executives were recently named as defendants in a securities class action lawsuit ...

Battea – Class Action Services, LLC Successfully Completes 7th Straight SSAE 18 Type II Examination Audit

STAMFORD, CT, July 17, 2017— Battea – Class Action Services, LLC, global leader and expert in all stages of asserting and processing settlement claims in ...

Toymaker Mattel, executives named in shareholder class action suit

A shareholder class action suit has been filed against Mattel and a handful of its executives in a case alleging high levels of unsold ...

Aaron’s, three executives named in securities class action lawsuit

The home goods leasing company Aaron's Holdings and certain of its executives were recently named as defendants in a securities class action lawsuit alleging ...

Securities class action lawsuit filed against Endo International

A securities class action suit has been filed against the drug maker Endo International and a number of its executives, alleging they did not ...

Battea Presents on Global Antitrust Litigation, at FX Invest North America, hosted by FX Week, at the Omni Parker House in Boston, MA

Battea – Class Action Services, LLC was honored to present on Tuesday, April 25, 2017 at the FX Invest North America Event, hosted by FX ...

Insys faces securities class action lawsuit over financial controls

Insys Securities Class Action The pharma company Insys Therapeutics, Inc., and certain of its executives were recently named as defendants in a securities class action lawsuit ...

Securities class action suit filed against mortgage lender Ocwen

Ocwen Securities Class Action The mortgage lender Ocwen and some of its executives were recently served with a securities class action lawsuit after months of garnering ...

Flower company FTD and executives facing securities class action suit

The flower delivery giant FTD and three of its executives were recently named as defendants in a securities class action lawsuit stemming from issues ...

BofI Holding faces securities class action suit

The holding company that controls the online financial institution BofI Federal Bank has been hit with a securities class action lawsuit alleging unlawful conduct ...

Securities class action suit filed against Aratana Therapeutics

The pet drug manufacturer Aratana Therapeutics and some of its executives were recently named as defendants in a securities class action lawsuit. The suit ...

Biotech firm BioAmber hit with securities class action suit

The bio-succinic acid manufacturer BioAmber Inc. was recently served with a securities class action lawsuit alleging that the company and some of its executives made ...

Securities class action suit hits auto manufacturer Kandi Technologies

The Chinese automaker Kandi Technologies and some of its executives were recently served with a securities class action suit alleging a number of false ...

Securities class action lawsuit filed against NantHealth, Inc.

NantHealth Securities Class Action The health development and marketing company NantHealth, a number of its executives, and other companies were recently named as defendants in a ...

Securities class action filed against Global Eagle Entertainment

The in-flight connectivity giant Global Eagle Entertainment was recently served with a securities class action lawsuit alleging potential false or misleading statements. To learn ...

Biopharma firm Alcobra served with securities class action suit

The biopharmaceutical company Alcobra Ltd. was recently hit with a securities class action lawsuit stemming from allegations that the firm and some of its executives made ...

Sito Mobile Faces Securities Class Action Over Ad Revenues

The mobile advertising platform Sito Mobile, which targets ads at users based on their location, is facing a securities class action lawsuit because it ...

Securities Class Action Lawsuit Filed Against Regulus Therapeutics

The biopharma company Regulus Therapeutics was recently hit with a securities class action lawsuit related to one of the drugs it was testing. To ...

Psychemedics Facing Securities Class Action Lawsuit

The drug-testing company Psychemedics Corporation was recently served with a securities class action lawsuit which alleges the company tried to maintain a monopoly on its ...

Securities Class Action Lawsuit Filed Against USANA

The nutritional products manufacturer USANA Health Sciences was recently served with a securities class action lawsuit alleging misconduct among both its executives and the ...

TG Therapeutics faces class action lawsuit over cancer treatment

TG Therapeutics The pharma company TG Therapeutics was recently served with a securities class action suit stemming from allegations that it made false or misleading ...

Securities class action against Natus Medical moving forward

A securities class action lawsuit has been filed against the newborn care and neurology products manufacturer Natus Medical stemming from allegations of the company failing ...

Securities class action lawsuit arrives for Yahoo

In the wake of two high-profile data breaches, the web giant Yahoo has been served with a securities class action suit alleging the company made ...

Securities class action suit filed against Innocoll Holdings

The medical device and pharma company Innocoll Holdings was recently hit with a securities class action suit stemming from allegations that one of its filings with ...

New Oriental Education hit with securities class action lawsuit

The China-based educational services provider New Oriental Education and Technology Group has been served with a securities class action suit. It alleges that the company ...

Dakota Plains Holdings faces securities class action lawsuit

The energy company Dakota Plains Holdings, and certain of its officers, were recently served with a securities class action lawsuit alleging a number of false ...

Ally Financial facing class action suit over 2014 IPO

Ally Securities Class Action The auto loan giant Ally Financial is facing a securities class action lawsuit stemming from allegations the company violated the Securities ...

Medical implant company Zimmer Biomet faces securities class action

Zimmer Biomet, a medical implant company best known for making replacement products for transplants such as hips and knees, was recently served with a ...

GoPro facing securities class action suit over drone malfunctions

The well-known technology maker GoPro is now facing a securities class action lawsuit over problems stemming from a drone released late last year. To learn ...

Securities class action suit coming for Dynavax Technologies

The pharmaceutical company Dynavax Technologies was recently hit by a securities class action suit alleging the company made false or misleading statements about one of ...

Ligand Pharmaceuticals facing securities class action

A securities class action lawsuit has been filed against the drug company Ligand Pharmaceuticals, alleging false or misleading statements about its financial situation and its ...

Securities class action suit filed against Diplomat Pharmacy

The pharma chain Diplomat was recently served with a securities class action suit alleging the company made a number of false and misleading statements. To ...

Securities class action suit filed against Arrowhead Pharmaceuticals

The drug manufacturer Arrowhead Pharmaceuticals was recently hit with a securities class action lawsuit after discontinuing a number of drug trials. To learn more about this ...

Alexion the latest pharma firm hit with securities class action

The pharmaceutical company Alexion has been served with a securities class action lawsuit concerning false or misleading statements about alleged sales practices. To learn more ...

Taro Pharmaceuticals faces securities class action

Taro Securities Class Action Securities class action lawsuit has been filed against Taro Pharmaceutical Industries, alleging a number of issues with its business practices. To ...

Impax hit with securities class action suit over antitrust allegations

Impax Laboratories Securities Class Action The pharmaceutical company Impax Laboratories was recently rocked by a securities class action lawsuit alleging false or misleading statements by the ...

Insurer Allstate served with securities class action suit

Allstate Securities Class Action Lawsuit The major national insurance company Allstate was recently hit with a securities class action lawsuit stemming from issues that first ...

Adeptus Health hit with securities class action after 2015 TV report

Adeptus Health Securities Class Action The standalone urgent care provider Adeptus Health, which operates numerous facilities throughout the U.S., is facing a securities class action ...

Securities class action lawsuit brought against Tyson Foods

Tyson Foods was recently hit with a securities class action lawsuit alleging that the company made misleading statements and did not disclose information crucial to ...

Xerox served with securities class action suit over Health Enterprise

Xerox, a brand most often associated with copier machines, is now facing a securities class action lawsuit over a software product that allegedly hasn't performed ...

Securities class action suit filed against Mylan Pharmaceuticals

Mylan Pharmaceuticals, the manufacturer of the popular EpiPen, was recently hit with a securities class action lawsuit alleging that it made false or misleading statements ...

Exxon Mobil facing securities class action suit over climate change

Exxon Mobil Securities Class Action Lawsuit The well-known fuel company Exxon Mobil was recently hit with a securities class action lawsuit alleging a series of ...

Securities class action suit filed against IT giant Cognizant

The IT and consulting firm Cognizant Technology Solutions is facing a securities class action lawsuit alleging that it made false and misleading statements about its ...

Securities class action suit filed against American Renal Associates

American Renal Associates Securities Class Action A securities class action lawsuit has been filed against the health care provider American Renal Associates, alleging false or ...

Engineering firm AECOM facing securities class action lawsuit

AECOM Securities Class Action The multinational engineering firm AECOM was recently served with a securities class action suit alleging that the company failed to disclose ...

Securities class action lawsuit filed against Power Solutions International

The engine manufacturer Power Solutions International was recently served with a securities class action lawsuit.The suit, filed in the U.S. District Court for the Northern ...

Polaris Industries faces securities class action suit

Polaris Securities Class Action The ATV manufacturer Polaris Industries was recently served with a securities class action lawsuit alleging the company misled investors over the ...

Seres Therapeutics hit with securities class action lawsuit

The drug manufacturer Seres Therapeutics was recently hit with a securities class action suit. For more information, visit Battea's Seres Therapeutics case summary. The filing alleges ...

Mining company Goldcorp hit with securities class action suit

Goldcorp Securities Class Action Lawsuit A securities class action lawsuit was recently filed against the Canadian mining company Goldcorp, stemming from allegations of false or ...

Securities class action lawsuit filed against Flowers Foods

Flowers Foods Securities Class Action Lawsuit Flowers Foods was recently hit with a securities class action lawsuit alleging that the company issued false or misleading ...

Securities class action lawsuit filed against Signet Jewelers

A securities class action lawsuit has been filed against the jewelry company Signet Jewelers, which controls a number of the best-known brands in its industry. ...

Wells Fargo hit with securities class action lawsuit

Wells Fargo Class Action The major national bank Wells Fargo was recently served with a class action lawsuit. For more information, visit Battea's Wells Fargo ...

Twitter hit with securities class action suit

Twitter Securities Class Action The popular social networking platform Twitter was recently named in a securities class action lawsuit. For more information, visit Battea's Twitter ...

Fiat Chrysler facing securities class action lawsuit

Fiat Securities Class Action The major auto manufacturer Fiat Chrysler Automobiles N.V. was recently hit with a securities class action suit. The lawsuit, filed in ...

Securities class action lawsuit filed against Spectrum Pharmaceuticals

A securities class action suit has been filed against the drug manufacturer Spectrum Pharmaceuticals alleging the company made false or misleading statements and failed to ...

Securities class action lawsuit filed against Hain Celestial Group

Hain Securities Class Action The health food company Hain Celestial Group was recently hit with a securities class action lawsuit. For more information, visit Battea’s ...

Securities class action suit filed against Global Digital Solutions

A securities class action lawsuit was recently filed against the manufacturing and security firm Global Digital Solutions, Inc., that alleged a series of misleading statements ...

Securities class action suit filed against P2P lender Yirendai

Yirendi Ltd. Securities Class Action Near the end of August, a securities class action lawsuit was brought against the China-based peer-to-peer lending company Yirendai Ltd., ...

Securities class action lawsuit filed against Warren Resources

A securities class action suit has been filed against the energy firm Warren Resources, alleging that the company issued a series of false and intentionally ...

Securities class action suit brought against Corrections Corporation of America

A securities class action lawsuit was recently filed against the private prison giant Corrections Corporation of America, alleging that the company made false or misleading ...

Securities class action suit filed against Fiat Chrysler Automobiles

FIAT SECURITIES CLASS ACTION Fiat Chrysler Automobiles, one of the best-known domestic auto brands in the U.S., has been hit with a securities class action ...

Tokai Pharmaceuticals, Inc., hit with securities class action lawsuit

A securities class action suit has been filed against the drug company Tokai Pharmaceuticals, alleging false and misleading statements and failure to disclose certain problems ...

Securities class action lawsuit filed against Ambac Financial Group, Inc.

Ambac Financial Group Securities Class Action A securities class action suit was recently filed against the holding company Ambac Financial Group, Inc., stemming from allegations ...

Securities class action suit filed against Eaton Corp., PLC

Eaton Corporation Securities Class Action A securities class action suit was recently filed against Eaton Corporation and certain senior executives, alleging the issue of false ...

Securities class action suit filed against pet food company Freshpet Inc.

A securities class action suit was filed against a pet food manufacturer following claims it and some of its officers and directors violated certain provisions ...

Class action claim filed against HP

HP Securities Class Action Attorneys Jahan C. Sagafi of Lieff Cabraser Heimann & Bernstein, LLP, and Adam T. Klein of Outten & Golden LLP announced ...

Law Firms Launch Investigations into JAKKS Pacific

JAKKS Pacific A handful of law firms announced recently that they are investigating JAKKS Pacific, Inc., which designs, builds and markets a wide range of ...

Annie’s receives securities class action lawsuit

A law firm recently announced that it filed a securities class action lawsuit against a food company after allegations of securities law violations.Robbins Arroyo, LLP, ...

Securities class action against K12 dismissed

On Dec. 8, 2014, online education provider K12, Inc. announced the dismissal of a securities class action in which it was a defendant.Securities class action ...

Securities class action settlement proposed for Maxwell Technologies suit

A securities class action settlement was recently proposed for a suit previously filed against Maxwell Technologies, Inc.Company background Based in San Diego, California, Maxwell Technologies ...

Securities class action suit filed against biopharmaceutical provider Emergent Biosolutions Inc.

Emergent Biosolutions Securities Class Action A securities class action suit was filed against a multinational specialty biopharmaceutical company and certain executives following claims they violated ...

Securities class action lawsuit filed against Stericycle, Inc.

Stericycle Securities Class Action A securities class action lawsuit was recently filed against a waste management company following claims the company breached federal securities laws. ...

Securities class action suit filed against biopharmaceutical company Juno Therapeutics Inc.

A securities class action suit was filed against a biopharmaceutical company following claims the cellular immunotherapy developer and some of its officers violated federal securities laws. ...

Securities class action suit filed against intelligence company Ability, Inc.

A securities class action lawsuit was recently filed against a well-known tactical communications tracking company following claims the company and certain executives breached federal securities ...

Securities class action suit filed against pharmaceutical company Lipocine Inc.

A securities class action suit was filed against a pharmaceutical company and some of its officers following claims they violated federal securities laws. The lawsuit ...

Securities class action suit filed against medical device company Unilife Corporation

A securities class action suit was filed against a medical company and certain executives following claims the defendants violated provisions of federal securities laws. The ...

Securities class action suit filed against DeVry Education Group Inc.

A securities class action suit was filed against a for-profit education corporation following allegations that failed to disclose certain information and release potentially false or ...

Securities class action suit filed against health care firm Perrigo Company PLC

A securities class action suit was filed against a health care products provider following allegations it violated federal securities laws. The lawsuit against Perrigo Company ...

Securities class action suit filed against aircraft leasing firm FLY Leasing Limited

A securities class action suit was filed against a commercial aircraft leasing firm following allegations that it failed to disclose certain information to investors. The ...

Securities class action suit filed against Apollo Education Group Inc.

A securities class action suit was filed against a corporation that operates several for-profit education institutions following claims that it violated federal securities laws. The ...

Securities class action suit filed against software provider PTC Inc.

A securities class action suit was filed against a software company following claims that it improperly attempted to bribe foreign government officials. The lawsuit against ...

Securities class action suit filed against aircraft corporation The Boeing Company

A securities class action suit was filed against an aircraft design, manufacturing and distribution corporation following allegations it violated federal securities laws. The lawsuit against ...

Securities class action suit filed against REIT Brixmor Property Group Inc.

A securities class action suit was filed against a real estate investment trust following claims that the REIT violated federal securities laws. The lawsuit against ...

Securities class action suit filed against biophamaceutical company NewLink Genetics Corporation

NewLink Securities Class Action A securities class action was filed against a biopharmaceutical company following allegations that it violated federal securities laws. The lawsuit against NewLink ...

Securities class action suit filed against REIT HCP Inc.

A securities class action suit was filed against a real estate investment trust following allegations it violated federal securities laws. The lawsuit against HCP Inc., HCR ManorCare Inc. and ...

A securities class action suit was filed against advisory firm PJT Partners Inc.

PJT Partners Securities Class Action A securities class action suit was filed against PJT Partners Inc., a global advisory-focused investment bank, following allegations that the ...

Securities class action suit filed against diagnostic device and service company Alere Inc.

Alere Securities Class Action A securities class action suit was filed against a diagnostic device and services provider following claims that the company did not ...

Securities class action suit filed against Performance Sports Group Ltd.

A securities class action suit was filed against a sports equipment manufacturer following allegations the company and certain officers and directors violated federal securities laws. ...

Securities class action suit filed against metals manufacturer Precision Castparts Corp.

A securities class action suit was filed against a manufacturer of metal components and certain officers following allegations that the company misrepresented its performance and ...

Securities class action suit filed against loan servicer Navient Corporation

Navient Securities Class Action A securities class action suit has been filed against a student loan servicing and collection corporation following allegations that it violated ...

Securities class action suit filed against food import company G. Willi Food-International Ltd.

G. Willi Securities Class Action A securities class action suit has been filed against an international food importer following allegations that the defendants violated federal ...

Securities class action suit filed against electronic design automation firm Mentor Graphics Corp.

Mentor Securities Class Action A securities class action suit was recently filed against an electronic design automation firm following allegations that it violated federal securities ...

Securities class action suit filed against marketing analytics firm comScore

comScore Securities Class Action A securities class action lawsuit was recently filed against a marketing data and analytics company following allegations that it and several ...

Securities class action suit filed against GoPro Inc.

A securities class action suit was recently filed against a camera manufacturer following claims that it violated federal securities laws by failing to disclose important ...

Scalia and the Landmark Morrison Decision: Limiting the Scope of Securities Class Actions in America

With the death of U.S. Supreme Court Justice Antonin Scalia, many are discussing his impact on American legal and political life. But in the arena ...

Securities class action suit filed against biopharmaceutical company Mannkind Corp.

A securities class action suit was filed against a biopharmaceutical company following allegations that it issued false and misleading statements and/or failed to disclose ...

Battea Helps Raise $180K for Charity with a San Francisco Poker Tournament

Imagine facing down one of the current or former chief executives and founders of Twitter, Levis, and Zappos across a poker table in a tense ...

Securities class action suit filed against biopharmaceutical company GW Pharmaceuticals Plc

GW Securities Class Action Lawsuit A securities class action lawsuit was filed against a biopharmaceutical company and some of its officers after claims that it ...

Securities class action suit filed against pharmaceutical company Insys Therapeutics Inc.

Insys Securities Class Action A securities class action suit was filed against a pharmaceutical company following allegations that it and certain officers violated federal securities ...

JPMorgan Chase & Co. Pays Out $150 Million Securities Class Action Settlement in Notorious “London Whale” Case

In a payout of historic proportions, JPMorgan Chase & Co. has agreed to pay $150 million in a class action settlement over investor claims that ...

Battea’s Adam Foulke Addresses Pension Funds: Don’t Leave Money on the Table!

On January 20, 2016, Adam Foulke, Senior Vice President, Business Development at Battea, addressed a group of prominent pension fund trustees at Koried’s 7th Annual ...

Battea’s Trent Calabretta Tells Public Funds Summit: Defend Your Assets!

On January 14, 2016, Trent Calabretta, Vice President and Battea’s Manager of Western US Sales, delivered a presentation entitled, "Defending Your Assets,’ to the Public ...

Securities class action suit filed against KaloBios Pharmaceuticals Inc.

KaloBios Securities Class Action A securities class action suit was filed against a biopharmaceutical company and certain officers following allegations that the defendants violated federal ...

2015’s Top 10 Class Action Distributions

In our previous article, we discussed 2015’s top 10 settlement cases in the field of class action settlements—cases where a substantial settlement fund was created ...

Securities class action filed against biopharmaceutical firm Anavex Life Sciences Corp.

A securities class action suit was recently filed against a clinical-stage bio-pharmaceutical company following claims that it violated federal securities laws by artificially inflating stock ...

Securities class action filed against medical device manufacturer HeartWare International Inc.

A securities class action suit was filed against a ventricular assist device developer and manufacturer following claims that the company and some of its senior ...

2015’s Top 10 Class Action Settlements

As we look back on 2015, we’ll be reviewing the top 10 settlement and distribution cases in the world of class actions settlements. Many are ...

How Battea Can Help You Work With a Claims Administrator

Remember the scene in The Wizard of Oz when the Wizard tells Dorothy, “Pay no attention to the man behind the curtain!”? Well, in a ...

International Coalition Announces the Formation of Stichting Petrobras Compensation Foundation, a Dutch Foundation Representing Investors Damaged By Petrobras et al; Offers International Investors Easy Access to Participation

Rotterdam, Netherlands -- Stichting Petrobras Compensation Foundation, a Netherlands-based claim foundation (the “Foundation”); International Securities Associations and Foundations Management Company for Damaged Petrobras Investors (Bovespa) ...

International Coalition Announces Criminal Lawsuit Against Petrobras et al in Spanish Criminal Court; Offers International Investors Easy Access to Participation

The Asociacion de Afectados de Petrobras, a Madrid-based shareholder association; International Securities Associations & Foundations Management Company for Damaged Petrobras Investors (Bolsa Madrid) Ltd. (“ISAF ...

Class action suit filed against Tetraphase Pharmaceuticals Inc.

A securities class action suit was filed against a clinical-stage biopharmaceutical company following allegations that the company violated federal securities laws. The lawsuit was filed ...

Securities class action suit filed against Third Avenue Management LLC

A securities class action suit was filed against a management and investment firm following allegations that it violated certain federal securities laws by including false ...

Class action lawsuit filed against wearable fitness device company Fitbit Inc.

A securities class action suit was filed against a company that develops, manufactures and distributes fitness products, after it was revealed that a component of ...

Class action suit filed against regenerative medical company Osiris Therapeutics Inc.

A securities class action suit was filed against a regenerative medical solutions provider following allegations that the company and some of its officers failed ...

Class action lawsuit filed against party goods supplier Party City Holdco Inc.

Party City Class Action A securities class action suit was filed against a designer, manufacturer and distributor of party goods following allegations that its initial ...

Class action lawsuit filed against flash storage company, Nimble Storage

Nimble Securities Class Action A securities class action suit was filed against a flash storage company following allegations that it violated federal securities laws by ...

UDF fails to disclose alleged similarities with Ponzi schemes

UDF Securities Class Action A securities class action suit was filed against a real estate investment trust following allegations that the REIT was operating a ...

Undisclosed licensure issues for Straight Path precede class action

A securities class action suit has been filed against a self-described "intangible asset monetization company" following allegations that it violated federal securities laws. The ...

Class action filed over proposed SolarWinds acquisition

SolarWinds Securities Class Action A securities class action suit was filed against an enterprise software provider following allegations that the company breached certain provisions of ...

Aixtron ADRs down after order dilemma

Aixtron ADRs Security Class Action Aixtron ADRs Security Class Action: Recently, a class action lawsuit was filed against a company that manufactures products for clients ...

Class action lawsuit filed against Vale S.A.

Vale Securities Lawsuit A securities class action suit was filed against a Brazilian multinational metals and mining corporation following allegations that it made false and/or ...

Securities Class Action Suit Filed Against Biopharmaceutical Company, Clovis Oncology Inc.

A securities class action suit was filed against a biopharmaceutical company that acquires, develops and markets cancer treatments in the U.S. and other markets following ...

Valeant Pharmaceuticals International Inc. Receives Class Action Lawsuit

A securities class action suit has been filed against a multinational specialty drugs company based in Canada, following allegations that the firm and some officers ...

Securities Class Action Filed Against Eros International PLC

A securities class action suit was filed against an Indian motion picture production and distribution company following claims that its statements on the economic viability ...

Galena Biopharma reaches $20 million settlement

Galena Securities Class Action A biopharmaceutical company announced that it has recently settled a securities class action suit brought against it and some of its ...

Revised finances result in class action against Checkpoint

Checkpoint Securities Class Action A class action lawsuit was filed against a merchandise availability solutions provider after the company allegedly violated federal securities laws. The ...

Securities Class Action Lawsuit Filed Against Sientra Inc.

Sientra Securities Class Action A securities class action suit has been filed against a company that develops and sells aesthetic medical equipment to plastic surgeons ...

Zafgen faces securities class action lawsuit

A securities class action suit was recently filed against a biopharmaceutical firm following allegations that the company made misleading misrepresentations about events in its clinical ...

Class action lawsuit filed against ConforMIS

A securities class action suit was recently filed against a provider of customized knee replacements after the company allegedly made false and/or misleading statements and failed ...

Securities Class Action Lawsuit Filed Against Extreme Networks, Inc.

Extreme Networks, Inc. Securities Class Action A securities class action suit was recently filed against a developer, manufacturer and installation provider of Ethernet computer network ...

USA Technologies dealing with securities class action suit

USA Technologies Securities Class Action USA Technologies Securities Class Action: A securities class action lawsuit has been filed against a company that provides the vending ...

Class action filed against Northwest Biotherapeutics

A securities class action lawsuit has been filed against a pharmaceutical company following allegations that the Maryland-based firm violated securities laws by making materially ...

Fifth Street Finance Corp. targeted by securities suit

Fifth Street Securities Suit A securities class action suit has been filed against Fifth Street Finance and some of its managers following claims that it ...

Lawsuit alleges OnDeck hid loan portfolio problems

A law firm filed a class action lawsuit against a small business financing company following allegations that the lender made materially false or misleading statements ...

Securities Class Action Suit Filed Against MaxPoint Interactive in connection with IPO

A law firm recently filed a class action suit against a hyperlocal online advertising company following allegations that it, some of its officers and the ...

Undisclosed ‘defeat devices’ lead to class action against VW

VW Securities Class Action A securities class action lawsuit has been filed against a car manufacturer following allegations that it failed to disclose it used ...

Overcharging claims lead to class action against Whole Foods

A securities class action lawsuit was recently filed against a natural and organic foods retailer following allegations that it violated federal securities laws. The class ...

SFX feels the effects of an allegedly unfair sale agreement

SFX Securities Class Action A securities class action lawsuit has been filed against an "end-to-end" electronic dance music "community" following allegations that the company misled ...

Class action suit filed against Constant Contact

Constant Contact Class Action A law firm has filed a class action claim against an online marketing solutions provider following allegations that the company violated ...

Concealed struggles lead to class action suit against El Pollo Loco

A securities class action suit was filed against a California-based restaurant chain following allegations that the company and its executives violated federal securities laws by ...

Undisclosed ex parte meetings lead to class action suit against Edison International

Edison Securities Class Action A law firm recently filed a securities class action suit against a public utility holding company following allegations that the firm ...

Allegations that XOMA misled investors leads to class action suit

A securities class action suit was filed against a biotechnology company on allegations that the firm misled shareholders in violation of federal securities laws. The ...

Class action suit claims VASCO stocks tumbled after disclosure of products sold in Iran

A law firm recently filed a class action lawsuit against an authentication and e-signature solutions provider, following allegations that the company violated federal securities laws. ...

Class action suit filed against ITG after adverse revelations about its alternative trading system

ITG Securities Class Action A class action filing was recently made against a trade execution services and solutions provider and some of its executives, whom were ...

Class action suit filed against IDI Inc. following legal issues

A securities class action claim has been filed against an information solutions provider alleging that the company violated federal securities laws. The law firm filed ...

Securities class action filed against Puma Biotechnology Inc. after disappointing trial

A law firm recently announced it has filed a class action lawsuit against a biotechnology company in an attempt to recover damages for alleged violations of ...

Class action claim filed against Toshiba after accounting cover up exposed

A law office has recently filed a securities class action claim against a Japanese multinational conglomerate following allegations the company released materially false and misleading ...

Class action suit filed against Avalanche Biotechnologies, Inc.

A class action suit was filed against a clinical stage biotechnology firm on allegations that officers and directors of the company made materially false and ...

Securities class action filed against Silver Wheaton Corporation

Silver Wheaton Corporation Securities Class Action A securities class action lawsuit has been filed against a precious metals streaming company for violations of federal securities ...

Class action lawsuit filed against Celladon Corporation following failed trial

A class action claim has been filed against a biotechnology company that allegedly violated federal securities laws for nearly a year by misleading investors about ...

Securities Class Action Litigation Filed Against 3D Systems Corporation

A securities class action complaint was recently filed against a 3D printing company alleging that for nearly 12 months, from 2013 to 2014, the firm ...

Vermont coffee company named in class action suit

A law firm has filed a federal securities fraud class action complaint against a coffee and coffeemaker company and some of its officers. The class ...

Class action filed against AirMedia after allegedly false valuation

AirMedia Securities Class Action A law firm recently announced it has filed a securities class action claim against a holding company that operates out-of-home advertising ...

Issues at Moema facility lead to class action filing against Solazyme

A law firm recently announced it has filed a securities class action suit against a biotechnology firm, alleging that the company violated the Securities Exchange Act ...

Class action suit filed against Nationstar following several dismal quarters

Nationstar Securities Class Action A securities class action lawsuit was recently filed against a mortgage services provider, alleging that the firm violated federal securities laws ...

RAYM faces class action suit following spin-off from Rayonier

A securities class action lawsuit has been filed against one of the United States' largest timberland owners following allegations that the the company made false ...

Etsy hit with class action suit following allegations of counterfeit products

A securities class action lawsuit has been filed against an online peer-to-peer e-commerce website for alleged violations of federal securities regulations. A number of law ...

Class action suit filed against Revance Therapeutics focuses on RT001 product

A law firm recently announced that it has filed a class action lawsuit against a specialty biopharmaceutical company following claims that its offering registration statement contained ...

Class action claim filed against Cadiz Inc. following water conservation setbacks

A complaint has been filed on behalf of all people who purchased common stock in a renewable resources company following allegations that it, as ...

Securities class action filed against CHC Group Ltd.

A securities class action was recently filed against CHC Group Ltd. CHC, based in Richmond, British Columbia, provides the global offshore oil and gas industry with ...

Securities class actions filed against Insulet Corporation

Insulet Corporation Securities Class Action Several securities class actions were recently filed against Insulet Corporation. The medical device firm, based in Billerica, Massachusetts, focuses on developing, ...

Securities class action claim filed against AudioEye, Inc.

A securities class action claim was recently filed on the behalf of AudioEye, Inc. shareholders. A securities class action claim was recently filed to represent AudioEye, ...

Securities class action claim filed to represent Walgreen Co. shareholders

A securities class action claim was recently filed on the behalf of the investors of Walgreen Co. Based in Chicago, Illinois, Walgreens is the single ...

Securities class action lawsuit filed against Quiksilver, Inc.

A securities class action lawsuit was recently filed against Quiksilver, Inc. The company, which is based in Huntington Beach, California, designs, manufactures and distributes clothing, ...

Securities class action filed against iDreamSky Technology Limited

A securities class action was recently filed against iDreamSky Technology Limited. Based in China, iDreamSky is the largest independent mobile game publishing platform in the nation, in ...

Securities class action filed against Boulder Brands, Inc.

A securities class action was recently filed against Boulder Brands, Inc. Boulder Brands is a consumer foods firm that makes and distributes food products to consumers. ...

Securities class action filed to represent Altisource Residential Corporation shareholders

Altisource Residential Securities Class Action Some securities class actions were recently filed on the behalf of shareholders of Altisource Residential Corporation, which trades on the ...

The Largest Securities Class Action Settlements in History

The Largest Securities Class Action Settlements in History While shareholders, companies and judges have been settling securities class actions for years, some of these particular ...

Securities class actions: The basics

Investors who may be eligible to take part in securities class actions can benefit from learning more about these legal actions. To help provide the proper ...

Securities class action suit filed to represent shareholders of Stratasys, Ltd.

Stratasys Securities Class Action A securities class action suit was recently filed on behalf of Stratasys, Ltd. shareholders. Based in Eden Prairie, Minnesota, Stratasys, Ltd. manufactures ...

Judge dismisses Fannie, Freddie securities class action

A federal judge recently dismissed a securities class action brought forth to represent the shareholders of Fannie Mae and Freddie Mac, the latest such decision ...

Securities class action filed against MOL Global, Inc., and certain officers

A securities class action was recently filed against MOL Global, Inc., as well as certain officers.MOL Global provides electronic payment solutions to customers in Southeast ...

Proposed securities class action suit filed against Pingtan Marine Enterprise Ltd.

A proposed securities class action suit was recently filed against Pingtan Marine Enterprise, Ltd.Securities class action suit filing Pingtan Marine Enterprise, Ltd. is a China-based ...

Proposed shareholder class action claim filed against Salix Pharmaceuticals, Ltd.

A proposed shareholder class action claim was recently filed against Salix Pharmaceuticals, Ltd.Salix Pharmaceuticals is a publicly-traded specialty pharmaceutical company that develops drugs and devices ...

Securities class action claim filed against Alcobra Ltd.

Alcobra Securities Class Action A securities class action claim was recently brought forth against Alcobra Ltd. Alcobra is a biopharmaceutical firm based in Tel Aviv, ...

Securities class action filed to represent AbbVie investors

A securities class action was recently brought forth on the behalf of investors in AbbVie Inc.Company background AbbVie, which is based in Worcester, Massachusetts, is ...

Securities class action settlement reached for ActivisionBlizzard suit

A securities class action settlement was recently agreed upon for a lawsuit involving video game maker ActivisionBlizzard, Inc.Based in Santa Monica, California, ActivisionBlizzard is a ...

Securities class action filed to represent Seadrill Limited investors

Seadrill Securities Class Action Lawsuit A securities class action was recently filed to represent investors in Seadrill Limited equities. Seadrill, incorporated in Bermuda and run ...

Securities class action suit filed on behalf of Conn's, Inc. investors

A shareholder class action suit was recently filed to represent organizations and individual investors who bought or otherwise came to own the securities of Conn's, ...

Securities class action filed to represent Petrobras investors

A securities class action was recently filed to represent certain investors in Petroleo Brasileiro S.A.The Rio de Janeiro, Brazil-based company, known as Petrobras, is a ...

Securities class action filed on behalf of Roka Bioscience, Inc.

A securities class action was recently filed to represent individuals and organizations that bought securities of Roka Bioscience, Inc. Headquartered in Warren, New Jersey, Roka ...

The Role of the Claims Administrator in Securities Class Action Settlements

The claims administrator plays a critical role in the class action process and it is important to have a general understanding of their responsibilities and ...

Preliminary securities class action settlement reached in JPMorgan Chase suit

JPMorgan Chase recently signed a preliminary securities class action settlement that would resolve a lawsuit involving more than $17.6 billion worth of securities sold ...

Preliminary securities class action settlement reached by Pfizer

Pfizer Securities Class Action Global pharmaceutical giant Pfizer, Inc. announced Tuesday, Jan. 27 that it has reached a preliminary securities class action settlement, which would ...

Securities class action filed against Home Loan Servicing Solutions, Ltd.

Home Loan Servicing Solutions, Ltd. Securities Class Action Company background Home Loan Servicing Solutions, which has its principal executive offices in the Cayman Islands, was ...

Securities class action suit filed to represent Alibaba shareholders

A securities class action suit was recently filed on the behalf of Alibaba Group Holding Limited shareholders. Alibaba is a China-based e-commerce giant. Using its ...

Securities class action filed against eHealth, Inc.

A securities class action was recently filed against eHealth, Inc.Company background eHealth, Inc. provides individuals, families and small businesses with an internet-based health insurance marketplace. ...

Securities class action filed representing Movado Group, Inc. shareholders

Movado Group, Inc. Securities Class Action Company background Movado Group, Inc. is a luxury watchmaker founded in 1983 and based in Switzerland. The firm, considered ...

Battea Sponsors 5th Annual Hedge Funds Care Poker Tournament

Battea was once again pleased to sponsor for the Hedge Funds Care West Coast Committee of Hope's Annual Poker Tournament, its fifth annual event. The ...

Securities class action settlement announced for Fuqi International, Inc. suit

A proposed securities class action settlement was recently announced for a lawsuit involving Fuqi International, Inc.Company background Through its subsidiaries, Fuqi International designs, produces and ...

Securities class action lawsuit filed to represent shareholders of InvenSense, Inc.

A securities class action lawsuit was recently filed to represent purchasers of InvenSense, Inc.'s common stock.InvenSense, Inc. is based in San Jose, California, and designs, ...

Securities class action lawsuit filed against Baker Tilly Hong Kong

A securities class action lawsuit was recently brought forth against Baker Tilly Hong Kong in relation to their role as an auditor of China North ...

Securities class action filed against ESB Financial, Inc., in relation to proposed sale

A securities class action was recently against ESB Financial, Inc., in connection with the company's proposed sale to WesBanco, Inc.ESB Financial, Inc. serves as a ...

Securities class action suit filed against FireEye, Inc.

A securities class action suit was recently filed against FireEye, Inc. Company basics Publicly traded and headquartered in Milpitas, California, FireEye is a network ...

Securities class action suit filed to represent RCS Capital Corporation investors

A securities class action suit was recently filed on the behalf of RCS Capital Corporation shareholders.Based in New York City, RCS Capital Corporation is a ...

Securities class action lawsuit filed on behalf of VBI Vaccines/PCC legacy shareholders

A securities class action lawsuit was recently brought forth to represent legacy shareholders of Paulson Capital Corporation, currently known as VBI Vaccines, Inc. Andrews ...

Proposed securities class action settlement for Silvercorp Metals granted preliminary approval

A securities class action settlement proposed for a lawsuit involving Silvercorp Metals, Inc., recently obtained preliminary approval. Company background Silvercorp Metals is a Canada-based mining ...

Securities class action lawsuit filed against Petroleo Brasileiro S.A.

A securities class action lawsuit was filed against Petroleo Brasileiro S.A.Petroleo Brasileiro S.A. is a semi-public global energy firm. It is based in Rio de Janeiro, ...

Securities class action lawsuit filed against Willbros Group Inc.

Willbros Securities Class Action A securities class action lawsuit was recently filed against Willbros Group, Inc. Willbros Group is a Houston-based international engineering and contracting ...

Proposed securities class action lawsuit filed against Aeterna Zentaris Inc.

Aeterna Zentaris Class Action A proposed securities class action lawsuit was recently brought forth against Aeterna Zentaris Inc. Company background Aeterna Zentaris Inc., based in ...

Catalyst Pharmaceutical proposes settlement for pending securities class action

Catalyst Pharmaceutical Securities Class Action Catalyst Pharmaceutical Partners, Inc. recently announced a proposed settlement for a pending securities class action. Securities class action filing On ...

Securities class action filed against Hanger, Inc.

Hanger, Inc. Securities Class Action A securities class action was recently filed against Hanger, Inc. Hanger, Inc. provides a comprehensive suite of orthotic and prosthetic ...

Proposed securities class action filed to represent American Realty Capital Healthcare Trust shareholders

American Realty Capital Healthcare Trust Securities Class Action A proposed securities class action suit was recently brought forth against the board of directors of American ...

Securities class action claim filed against Education Management Corporation, certain officers

A securities class action claim was recently brought forth against Education Management Corporation, as well as certain officers.EDMC, based in Pittsburgh, Pennsylvania, provides private and ...

Securities class action claim filed against iBio, Inc.

iBio Securities Class Action A securities class action claim was recently filed against iBio, Inc. Company background IBio is a pharmaceutical firm that leverages its ...

Proposed securities class action lawsuit filed against GreenStar Agricultural Corporation

A proposed securities class action lawsuit was recently brought forth against GreenStar Agricultural Corporation, its former auditor, as well as current and former directors and ...

Securities class action suit filed against Flagstar Bancorp, Inc. and certain officers

Flagstar Bancorp, Inc. Securities Class Action Flagstar Bancorp is the holding company for Flagstar Bank, which has more than $9.6 billion in assets, and is ...

Securities class action filed against BBSI

BBSI Securities Class Action A securities class action was recently brought forth against Barrett Business Services, Inc., as well as certain officers. BBSI provides business ...

Securities class action lawsuit filed against Retrophin, Inc. and certain officers

Retrophin Securities Class Action A securities class action lawsuit was recently filed against Retrophin, Inc. and certain officers. Retrophin background Retrophin is a biopharmaceutical firm ...

Class action lawsuit filed against Pacira Pharmaceuticals, Inc.

The Rosen Law Firm, P.A. announced on Oct. 6, 2014, that it had brought forth a class action lawsuit against Pacira Pharmaceuticals, Inc., a specialty pharmaceutical ...

Securities class action lawsuit filed against AcelRx Pharmaceuticals

AcelRx Pharmaceuticals Securities Class Action A law firm recently announced that it had filed a securities class action lawsuit against AcelRx Pharmaceuticals, Inc. The suit ...

Securities class action lawsuit filed against Genworth Financial, Inc.

A securities class action lawsuit was recently filed against major insurance firm, Genworth Financial, Inc., as well as certain corporate officials. Securities class action lawsuit ...

Securities class action suit filed against Arrowhead Research Corporation

A securities class action suit was recently filed against Arrowhead Research Corporation, as well as certain officers.Arrowhead is a biopharmaceutical firm that develops targeted RNA ...

Securities class action filed against ITT Educational and certain officers

A securities class action was recently filed against ITT Educational Services, Inc. and certain officers.ITT Educational Services is a for-profit educator that provides postsecondary degrees ...

Securities Class Action Lawsuits: Role of the Lead Plaintiff

When talking about securities class action suits there is a list of key players involved. These parties include: attorneys – which represent both the plaintiff ...

PDL BioPharma, Inc. receives securities class action lawsuit

A law firm recently announced that it filed a securities class action suit against a biotechnology company for alleged breaches of federal securities laws. Gainey ...

Penn West Petroleum Ltd. securities class action lawsuit

Penn West Securities Class Action Lawsuit A law firm recently announced that it has filed a securities class action suit against a Canadian oil and ...

Securities class action claim filed against EveryWare Global, Inc.

A law firm recently announced that it filed a securities class action claim against EveryWare Global, Inc.Scott+Scott, Attorneys at Law, LLP indicated on Oct. 7, ...

Enzymotec Ltd. receives securities class action lawsuit

Enzymotec Securities Class Action A law firm recently announced it has filed a class action lawsuit against a Enzymotec, nutritional ingredients and medical foods manufacturer, ...

Rocket Fuel Inc. receives securities class action lawsuit

A law firm recently announced it filed a securities class action suit against a marketing platform provider for alleged breaches of federal securities laws. Wolf Haldenstein ...

Regado Biosciences, Inc. receives securities class action lawsuit

A law office noted recently that it filed a securities class action lawsuit against a biopharmaceutical company, alleging certain breaches of the Securities Exchange Act of ...

LightInTheBox Holding Co. Ltd. reaches class action settlement

LightInTheBox Securities Class Action An online retail company recently announced that a class action settlement has been reached between the e-commerce business and its shareholders. ...

Lions Gate Entertainment Corp receives securities class action lawsuit

A law firm recently announced it has filed a securities class action lawsuit against an entertainment company for potential breaches of federal securities laws. ...

Santander Consumer Holdings receives securities class action lawsuit

A law office recently noted it had filed a securities class action lawsuit against a consumer finance company following its failure to disclose alleged inappropriate ...

Lannett Company, Inc. receives class action lawsuit

A law firm recently announced that an investor has filed a class action lawsuit against a pharmaceutical marketing company for possible violations of federal securities laws.Pomerantz, ...

Bally Technologies receives securities class action lawsuit

A law office recently noted that it filed a securities class action lawsuit against a gaming device manufacturer after its owners agreed to a merger ...

Winn-Dixie Stores agrees to class action settlement

A law office recently explained that a retail chain came to an agreement with its shareholders to settle a securities class action lawsuit.Robbins Geller Rudman ...

Trulia sale prompts securities class action lawsuit

Trulia Securities Class Action Lawsuit A law firm noted that it filed a securities class action lawsuit against a real estate company after its leaders ...

Family Dollar Stores receives securities class action lawsuit

Family Dollar Securities Class Action Lawsuit A law office recently noted that it filed a securities class action lawsuit against a retail chain after its ...

Covidien receives securities class action lawsuit

A law office recently announced that it filed a securities class action lawsuit against a health care company, due to potential violations of federal securities ...

Key Energy Services receives class action lawsuit

Key Energy Securities Lawsuit A law office recently noted that it filed a securities class action lawsuit against an energy company due to shareholders alleging ...

InVivo Therapeutics Holdings receives securities class action lawsuit

A law office recently announced that it filed a securities class action lawsuit against a spinal cord injury treatment company due to potential violations of ...

China Green Agriculture reaches securities class action settlement with shareholders

China Green Securities Settlement A fertilizer company recently announced that it reached a securities class action settlement with shareholders and the action was approved by ...

EDAP receives securities class action lawsuit

A law office noted that it recently filed a securities class action lawsuit against a medical device manufacturer due to potential violations of federal securities ...

Ocwen Financial Corporation receives securities class action lawsuit